by Laurie Israel, Esq.

More older couples are getting divorced in their middle years or even after reaching 65 years of age. A Pew Research study shows that although the overall divorce rates have been declining, the frequency of divorces among people 50 has more than doubled. Among the 65-and-older set, the divorce rate has tripled. Some of these divorces are among people whose marriages lasted 30 or even 40 years.

The new term for a later-in-life divorce is a “gray” divorce. And many of these newly-divorced people are getting married again. They are concerned about their retirement, and what happens if they get divorced again.

Balancing loyalty between new spouse and children from previous marriages.

Many seniors remarrying want to leave a legacy to the children of their first marriage when they die. Depending on their financial situations, they also may be concerned about protecting the financial security of their new spouse.

As a result, many seniors are considering whether or not to have a prenup (a “gray” prenup) in place before their marriage. One of the planning issues in a “gray” prenup is how to address the financial well-being of the new spouse as well as the desire to leave assets to one’s own children at death. Balancing these interests is an important way to create harmony and trust in the newly blended family.

A prenup can be used to solidify a specific estate plan that balances the needs of the new spouse with the desire to give one’s children a “leg up.” Without a prenup, an estate plan can be changed at any time, without warning. In a prenup, a couple can decide what percentage of an estate can be left to each other, and what percentage will go to the children of a prior marriage.

It can set a minimum “floor” on transfers to each other upon death, which can be exceeded if one wishes. All or some of the assets designated for the surviving spouse can be put into a credit shelter trust or QTIP trust. These trust assets can be used to support the surviving spouse during that spouse’s remaining lifetime, with the remainder going to the children of the prior marriage.

A prenup can also specify what the newly formed couple will tell their children about the prenup. It can range from specifics (including showing the agreement to their children), to just saying, “We have a prenup, and it takes care of ourselves, and also all of you children.”

How to handle retirement assets in a gray marriage.

Retirement assets are an important source of income to retirees in a “gray” marriage. A couple can decide in a prenup whose retirement assets they will draw from to support themselves. At death, surviving spouses can delay starting required payouts of retirement assets (RMDs) until the year after they age 70 ½. A non-spouse beneficiary such as a child must start withdrawing RMDs from an inherited retirement account or IRA immediately according to their own life expectancies.

In a “gray” marriage, the couple can think about how to divide their retirement accounts at death between the surviving spouse and the children of a prior marriage. Will the surviving spouse need all of the retirement funds, or can it be divided at the first spouse’s death between the surviving spouse and the children of the prior marriage? Perhaps the surviving spouse does not need the funds, and they can be given by the participant spouse to the children at his or her death.

A prenup can modify the beneficiary rights of surviving spouses to retirement assets (such as 401(k) and some 403(b) plans) that are subject to ERISA law. Traditional IRAs are not subject to ERISA.) In this way, more of a retirement asset can go to a “gray” spouse’s children, if that’s what the couple wishes. It is important, however, to follow up the prenup commitment to waive spousal rights with a written consent required to be filed after the marriage takes place.

When preparing a prenup, life insurance policies and plans also should be reviewed and updated as needed. Sometimes couples find when they review their life insurance beneficiary designation forms, they may find that an ex-spouse is still named as beneficiary.

The nursing home cost risk in a “gray” marriage.

There are lots of upsides to marriage, both financial and emotional. This is why people get married in spite of the high divorce rate. However, a noteworthy consequence of legal marriage has to do with payment of skilled nursing facility (“nursing home”) bills.

Medicare benefits coupled with a Medigap insurance policy will cover only about 100 days in a skilled nursing facility. After that, private payment is required. Nursing home costs now range from $120,000 to $200,000 a year, depending on the geographical area. Engaging trained aids to provide 24-hour care in your home (plus the costs of running your home) can cost even more.

It is not clear what percentage of people end up in nursing homes for more than 100 days. One trade group says of the people who enter a skilled nursing facility, 44 percent stay less than one year and 30 percent stay between one to three years. It is those longer stays that can have a severe impact on a couple’s financial assets and security.

A married couple is responsible for each other’s nursing home costs under federal and state laws before a spouse’s nursing home costs are paid for by Medicaid. The separate assets and income of the spouse in the nursing home are generally used first to defray costs with that person being about to retain $2,000 in financial assets. But after that, the assets of the spouse who is not in the nursing home will be used for payment, until that spouse has only about $124,000 in financial assets left, plus the family home.

A prenup cannot change this law because it a private contract and is (in this aspect) overridden by Medicaid laws. As a result, couples marrying later in life might consider purchasing long-term care insurance to mitigate the financial damage that would result if one of them ends up in a nursing home for a long stay.

If you decide to have prenup, what process is best?

One of the good aspects of prenups, is that they can lessen the risk of litigation if the new marriage ends in divorce. It can even address conflicts that might arise after a spouse’s death at a time the marriage is ongoing. An alternative dispute resolution (ADR) method such mediation, collaborative law or binding arbitration can be written into the prenup as a requirement.

If a couple has decided to have a prenup, many have found mediation to be the best first step in starting the process. The couple mutually determine the terms that will be in the prenup together during discussions in real time, facilitated by a trained mediator.

Published in MarketWatch on December 3, 2018.

© 2018. Laurie Israel. All rights reserved.

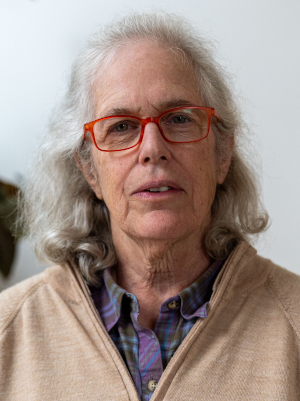

Laurie Israel is a lawyer located in Brookline, Massachusetts, working with high net worth clients planning for their marriages. Her writings on prenuptial agreements have appeared in the New York Times, the Wall Street Journal, and the Huffington Post. She is the author of the recent book “The Generous Prenup: How to Support Your Marriage and Avoid the Pitfalls.”

- Mediation – A Sound First Step to a Successful Prenup - September 27, 2022

- The Art of the Term Sheet - May 18, 2022

- Learning from Every Mediation - August 4, 2021